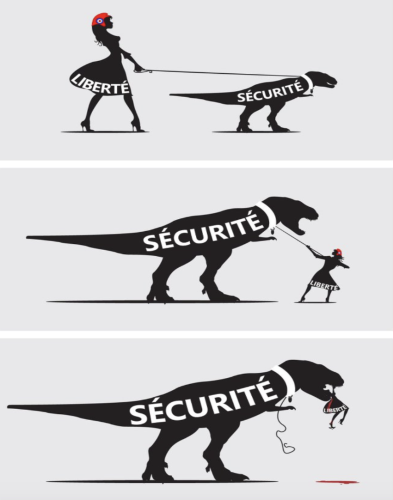

The narrative around “we are all criminals unless proven otherwise” has been so normalized that it perfectly matches the image chosen for this post.

Recent developments with the Samourai Wallet case has reminded us all again, that we are still very vulnerable against the “machinery of the state” and that we are entering probably the most crucial time of the “Then they fight you” Bitcoin cycle.

The current events happening in Bitcoin are almost like a psyop, and it feels again that those Block size wars times are back, but even harder.

This also needs to be a reminder that Bitcoin is not inevitable, at least not in the form we most want it to be, so we all need to stay together as an industry and not be afraid and be even more proud of what we do. We also fully understand and respect that companies may react by leaving certain jurisdictions and or shut down their operations as they feel threatened by almost all the nonsense and authoritarian rules and regulations that they want to impose on all of us. But great things have never been built with fear, and influencers and most players in general, had it easier back then during the “first they ignore you, then they laugh at you” cycles.

Despite all this, we remain positive and focused towards our mission and we think it is a good idea to look back at the fiat world of payments and ecommerce:

We still remember how ecommerce and payments grew thanks largely to the work done by payment gateways back at the time. That revoluti0n in payments and risk management driven by tech providers came at the cost of strict regulations around those very providers that did help merchants and consumers to transact easier and more securely, and they were forced to fall under a series of regulations and compliance obligations to simply continue being in the game.

The evolution was something like this:

- From simple credit card Gateways to PSPs supporting multiple payment methods and other added value services to merchants such as risk management and reporting capabilities

- PSPs become Acquirers and Acquires become PSPs

- Tighter regulations/obligations (PCI, AML, Emoney or PI Licence, etc)

- Consolidations into what we call Fintech today and the new era of Open Banking and Instant Payments

- Payments became a commodity due to lower margins in processing fees, so revenue moved to Risk Management solutions to be offered, specially in high risk industries like gambling

- Payment wars and M&As grew to another level but innovation was almost killed and regulation also moved to merchant level, to the point that most decided to simply offer their products in big platforms like Amazon or similar

With this in mind, and as mentioned in our previous post, we are positive that the next generation of node tech will surely be a driver for not just adoption at merchant/enterprise level, but also a catalyst for users and merchants to be in control of their Bitcoin payments and holdings.

In our community offering, via our Shuken Explorer, we started a while ago to set the foundations of what we call Counter-Chain Analysis, which despite what some may think, it is just a tool to empower merchants and individuals to stay ahead of the game.

Similar to what we mentioned in point 5 above regarding the boom of Risk Management tools in PSPs, we do envision that merchants and consumers will need and demand similar tools that do help them not be treated as criminals in the eyes of others.

But there is a big difference this time in comparison to the Risk Management tools used in the fiat world, and or the existing Bitcoin “surveillance” companies, and that is that this tool will come by default in every Bitcoin node that decides to leverage on it. Not only will it be based on public on-chain data, but other layers too (public and or private) that will ultimately help those who run it. One of the benefits and use cases would be to have all your private labels in one place, in addition to having extra information that may be shared by others that decide to make that public.

Before we close on this topic, we wanted to give a special mention to the team at OXT.me, that for many years they have been providing top quality information on your UTXOs. Unfortunately it has been taken down as part of the Samourai case. They are probably the best on-chain analysts in the market and we are sure their work will continue one way or the other.

Some may say that with tools like that, those working on the narrative to make us all criminals unless proven otherwise, will have even more power. But we see it differently, mainly because it will force users and merchants to be one step ahead in their UTXO management, but also give them tools to do so, beyond the existing labeling ones we have at wallet level like BIP-329.

And remember the mantra if you want to be as close to sovereignty as you can be in the Bitcoin era:

- Remember that KYC is surely not the only option to stack your sats

- Not your keys, not your coins

- Not you node, not your rules (money in the case of LN)

- and Control your coins before others do. Counter CA for all!

- Once you control your coins it will become easier to know what to do with each of them (rules based approach triggers)

- Make sure the “Sécurité” does not end up stealing your “Liberté”

Happy Sovereignty!